Save for your first home with the market-leading Lifetime ISA

Save up to £4,000 each year towards your house deposit and get a 25% government bonus. Open an account with just £1 or transfer today. No introductory rates, no fees.

Scan the QR code to download the app

Join 350,000 others saving for their

first home.

Watch: Tembo

LISA in under 2

mins

Already have a LISA?

Transferring to our market-leading LISA is easy, and over 5-years that simple switch would increase your deposit by hundreds versus the next best available rate. Plus, we’ll have your money transferred in as little as 4 weeks.

Open the app and select ‘No, I’ve got a LISA already’ to start your transfer.

Trusted

Rated ‘Excellent’, multi-award winning and trusted by thousands to make home happen. Tembo is also backed with investment from Aviva.

Regulated

We are authorised and regulated by the Financial Conduct Authority. Your financial wellbeing is our top priority.

Protected

Up to £85,000 of your money is eligible for protection under the Financial Services Compensation Scheme.

Secure

We encrypt and protect all data with banking-level security to keep you and your money safe.

How does it work

A Lifetime ISA is a smart way to save a deposit for your first home faster. You can open a new account if you’re between 18-39. Already have a LISA? Switch to our market-leading interest rate in under 5-minutes.

Why use a Lifetime ISA?

£1,000 annual bonus: Contribute the maximum £4,000 each tax year and you’ll get a 25% bonus. Or £1 extra for every £4 saved.

Tax-free benefit: The money you save or invest, plus the interest or investment gains are totally tax-free.

Save over the long-term: You can keep paying in until you turn 50, and receive a maximum bonus of £32,000.

Save or invest: Depending on your risk appetite and timeline to buy, you can choose a Cash LISA or a Stocks & Shares LISA.

Why Tembo?

Here’s a snapshot of what our app and service can do for you.

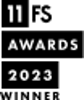

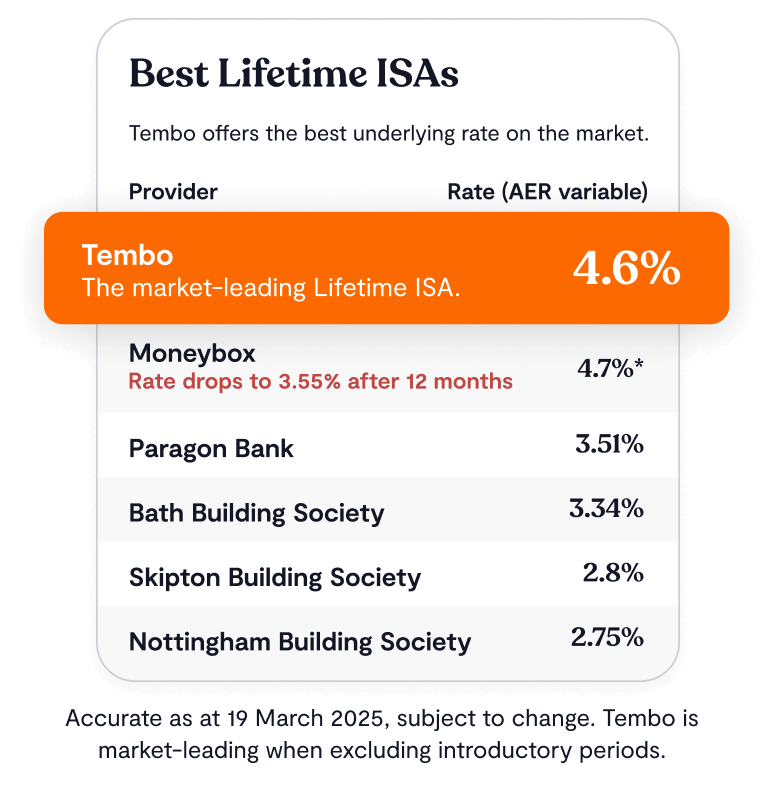

Boost your savings with our 4.33% interest rate

After 5-years, you could get hundreds more in your pocket versus the next best rate on the market. That’s because the Tembo Lifetime ISA comes with a market-leading 4.33% AER (variable) with no drop-off after year one.

Sign up in minutes

Sign-up to our app to kickstart saving for your first home, or transfer your funds over to us. You have to have your Lifetime ISA open for 12-months before you can use it to buy, but that timer doesn’t reset if you switch to Tembo. Once you’ve signed up, we’ll have your money transferred in 4-6 weeks.

Reduce your time to buy

We’ll show you your time to buy when you sign-up to Tembo. Then, we’ll give you all the tips and guidance you need to reduce that timeframe. From AI-driven insights into your spending to smart mortgage solutions that boost affordability by an average £82,000.

By your side until move in day

As well as our Lifetime ISA, Tembo offers a mortgage service and was voted the UK’s Best Mortgage Broker by its customers two year’s running. When you’re ready to buy, you’ll be allocated your own dedicated buying team, to get you the best mortgage deal.

Featured in

Save or invest

There are two ways to grow your deposit with Tembo — save it or invest it.

If you save in cash, your money and the government bonus gains interest over time. Nice and simple!

If you choose to invest, your money and the 25% government bonus will go into a fund which buys shares of companies and other assets. Investing tends to be a good long term option (think five years plus), but the value of your investment could go down, which would mean it could take longer to reach your goal. It all depends on how much risk you want to take and when you want to buy your home.

Either way, we’ve got options for you:

Tembo Cash Lifetime ISA

Save into a cash account with Tembo, and we'll hold the money on your behalf with our partner bank(s).

Get a 25% government bonus on your cash savings, up to £1,000 each year.

Earn 4.6% AER (variable) interest rate (annual equivalent rate — aka: per year) on the balance of your account, including the 25% government bonus.

Open your account at least 12 months before you plan on buying a home.

Bonus and interest are tax-free.

Eligible for FSCS-protection up to £85,000.

Give 45 days notice before withdrawing, unless for a qualifying house purchase (which takes up to 30 days) or retirement.

25% early withdrawal charge to the government.

Lifetime ISA transfers accepted.

Tembo Stocks & Shares Lifetime ISA

Invest in the BlackRock MyMap 5 Select ESG (ethical, sustainable and governance) Fund.

Get a 25% government bonus on the money you put into your account, up to £1,000 each year.

You don't earn a fixed rate of interest, instead you invest into assets that can go up or down.

Open your account at least 12 months before you plan on buying a home.

Bonus and return on investments are tax-free.

Eligible for FSCS-protection up to £85,000.

No notice period for withdrawals.

25% early withdrawal charge to the government.

Lifetime ISA transfers accepted.

Account fees

You didn’t think we’d hide them in the small print did you? For an account with a 25% government bonus and a financial friend in your back pocket, here’s how much it’ll cost:

Cash fees

Monthly membership fee:

£0

Heads up: Tembo receives interest on the money it holds for customers. This interest isn't a fee, we just wanted to let you know.

Stock & Shares fees

Monthly membership fee:

£0

Tembo annual platform fee:

0.35%

Investment funds also have their own charging structure. The fund we offer currently charges 0.17% per year.

Investing involves risk

If you open a Tembo Stocks & Shares Lifetime ISA, it’s important that you know the value of your investment could go up as well as down. You could get back less than you put in, which means it would take you longer to buy your first home. Past performance is not necessarily a guide to the future and investing is not intended to be a short-term option. We can’t and don’t provide financial advice so please be sure that investment risk is right for you.

Need to knows

When does the 4.6% rate apply from?

Who can open a Lifetime ISA?

Lifetime ISAs are designed for first-time home buyers who want to boost their house fund, or people retiring over the age of 60 who want to boost their pension. There are some other eligibility rules that apply. To open a Lifetime ISA, you must:

Be a UK resident Be between 18 – 39 years old Be a first-time buyer Buy a property in the UK, for less than £450,000 Buy with a mortgage (i.e. you can’t pay for it in full upfront) Live in the property once you buy it (no Buy to Let mortgages) Have your Lifetime ISA open for at least 12 months before you withdraw your money

🚨 IMPORTANT 🚨

If you withdraw your money for any other reason than buying your first home or for retirement once you’re 60, you’ll have to pay an early withdrawal charge of 25% to the government. This means you would get back less than you paid in, as you’d lose the government bonus and pay the government an extra £6.25 for every £100 you deposited.

Can I open a Tembo Lifetime ISA if I already have a Lifetime ISA?

Yes, absolutely. If you already have a LISA, you can transfer your funds to us to take advantage of the higher interest rate. Transferring will only take a few minutes in the Tembo app, and your money will land in the account in 4-6 weeks (depending on how speedy your old provider is!)

You can only pay into one Cash Lifetime ISA or one Stocks & Shares Lifetime ISA every tax year (April 6th to April 5th). So if you have paid into one Lifetime ISA already this tax year, but want to open and pay into another one, you can either transfer your funds to us, or wait until the new tax year begins on April 6th.

Can I open a Lifetime ISA and an ISA?

Can I transfer my Lifetime ISA to Tembo?

Yes, it’s super easy to transfer your savings to a Tembo Lifetime ISA, plus you’ll benefit from our market-leading interest rate! It only takes a few minutes to sign up through our app. Make sure you select the ‘I already have a LISA’ when you get to that stage. We’ll then send you a form via email that you can fill in electronically (you’ll need to know your account number and current provider’s details) then we take care of the rest.

Please note that it can take up to 6 weeks for your funds to reach us from your current provider.

Can I transfer an ISA to Tembo?

How can I withdraw my money from a Lifetime ISA?

You can withdraw money when you are buying your first home. The funds are transferred to the solicitor (conveyancer) who is advising you on your home purchase. You can also withdraw funds when you reach the age of 60.

🚨 IMPORTANT 🚨

You always have access to your money (subject to a notice period) but if you withdraw your money for any other reason than buying your first home or for retirement once you’re 60, you’ll have to pay an early withdrawal charge of 25% to the government. This means you would get back less than you paid in, as you’d lose the government bonus and pay the government an extra £6.25 for every £100 you deposited.

Can I cancel my Lifetime ISA?

Can I use a Lifetime ISA to buy a house with someone else?

Yes, if you are both first-time buyers and each have a Lifetime ISA open for at least 12 months, you can both use your Lifetime ISAs to buy a house together. With the Tembo Lifetime ISA app, you can use our team up feature to combine your deposits together and get double the 25% bonus!

If you’re buying a house with someone who isn’t a first-time buyer, they won’t be able to use a Lifetime ISA towards the house purchase. However, you will still be able to use your Lifetime ISA towards the purchase. This is because Lifetime ISAs are tied to people, not properties.

Can I use a Lifetime ISA to buy a Shared Ownership property?

How secure is a Tembo Lifetime ISA?

With the Tembo Lifetime ISA, your savings are held in a banking-level security account and are also protected by the Financial Services Compensation Scheme. This means that if one of the banks we partner with to hold your Cash Lifetime ISA money were to go into default, your money would be protected through the FSCS, up to £85,000 (per eligible person, per bank).

Similarly, if you have a Stocks & Shares Lifetime ISA, the units held are in a fund managed by BlackRock Fund Managers Limited. This is an FCA ‘approved’ fund and the units held are FSCS protected, up to a value of £85,000.

Tembo is also authorised and regulated by the Financial Conduct Authority (FCA), and as such abides by strict governance and compliance rules.

What is the Financial Services Compensation Scheme?

The Financial Services Compensation Scheme (also known as FSCS) is the financial institution that protects your money when the authorised financial services firms that hold your funds go out of business and can’t pay your money back. It was set up by the government and is independent from other financial institutions like banks. Through the FSCS your funds are protected up to a value of £85,000.

Please note, Tembo does not hold your LISA savings - instead, they are held by our partner banks. If these banks were to go under, you could be entitled to compensation of up to £85,000 (per person, per institution) through the FSCS.

How is a Tembo Stocks & Shares LISA sustainable?

How have we worked out our calculations?

There are a couple of different figures on this page, so we thought we’d explain how we’ve worked them out.

Over 5-years that simple switch would increase your deposit by an extra £850 versus the next best available rate. This is based on saving the maximum amount in a Lifetime ISA each year, with a 4.6% AER (variable) interest rate paid monthly, in comparison to the next best available rate (currently with Moneybox) at 4.6% for the first year, then dropping to 3.55% afterwards.

Let’s make home happen